ANSWER:

In reviewing unit budget requests and formulating the operating budget for the upcoming fiscal year, the Department of Management, Budget, and Planning reviews actual expenditures trends account by account to determine if amounts should be increased, reduced, or realigned to higher priority needs. However, when developing the budget, actual expenditures for the current year are not available. For example, the FY 2015 budget was developed in the fall of FY 2014, and FY 2014 was just beginning. Therefore, FY 2013 actual data was the latest year of data available. Similarly, FY 2014 actuals were the latest year of actuals available when the FY 2016 budget was developed.

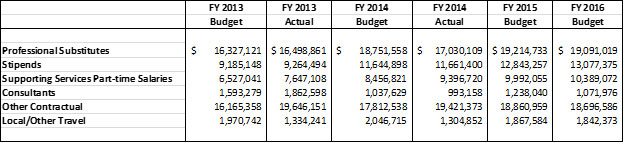

The following chart provides budgeted and actual expenditures for FY 2013 and FY 2014, and budgeted amounts for FY 2015 and FY 2016. The amounts exclude amounts in grants and enterprise funds. Projected actual amounts for FY 2015 are not included. It is too early based on the expenditure restrictions put in place on November 24, 2014. Explanations of the numbers are provided below.

Professional Substitutes:

For each new classroom teacher budgeted for growth in student enrollment, an amount is added for 11 short-term substitute days per teacher position. In addition, substitutes are budgeted for professional development and other school activities. While FY 2013 actual expenditures closely match the budget, FY 2014 actuals are lower than the FY 2014 budget due to less substitute usage. The lower usage can be partially explained by the fact that schools were closed for ten days due to weather emergencies and class coverage by substitutes was not required. In addition, some non-required training did not take place and was not rescheduled. The change from the FY 2014 budget to the FY 2015 budget is primarily a result of the impact of the general wage adjustment(GWA) approved for FY 2015 that was added for substitute salaries. The change from the FY 2015 to FY 2016 budget includes a reduction in the base budget due to realignment of $250,000 to long-term and sick and annual leave, and a reduction of $306,671 for kindergarten assessment professional learning. This if offset by $454,122 added for the impact of the FY 2016 GWA on substitute salaries.

Stipends:

A significant amount of the funds budgeted for stipends are for extracurricular activity stipends. In the budgets for FY 2013–FY 2016, extracurricular stipends account for 84 percent, 66 percent, 41 percent, and 41 percent of the total stipend budget, respectively. Other amounts for stipends are budgeted for professional learning and other activities outside of the school day or during the summer, curriculum development, and to pay staff for activities as designated in the negotiated agreements. The $1.1 million increase in the budget from FY 2014 to FY 2015 consists of an increase of approximately $358,000 for the change in the extracurricular stipend rate from $14 to $14.50 per hour, and approximately $721,000 related to new strategic enhancements. For FY 2016, $420,957 is added for stipends related to new strategic enhancements.

Supporting Services Part-time Salaries:

Actual expenditures for both FY 2013 and FY 2014, exceeded the amounts budgeted by approximately $1 million. However, the FY 2015 and FY 2016 budgeted amounts are more closely aligned with the FY 2014 actual figures. The FY 2015 amount is $1.5 million more than the amount budgeted for FY 2014. Of this increase, $278,333 is related to the fact that all supporting services part-time salaries were increased by the percent of the general wage adjustment (GWA) approved for FY 2015. Also, an increase of $729,457 was added to the budget for critical staffing paraeducators that provide services to special education students with highly intensive needs. The increase of $420,957 from the FY 2015 budget to the FY 2016 budget is a result of the GWA approved for FY 2016.

Consultants and Contractual Services:

For FY 2013 and FY 2014, actual expenditures exceeded budget amounts. This is largely the result of legal fees; consultants and contractual services for technology services due to position vacancies; contractual speech, occupational, and physical therapy services provided as a result of position vacancies, and contractual maintenance (snow removal) in the Division of Maintenance.

Local/Other Travel:

Most of the funds are budgeted to reimburse staff for local travel mileage based on the latest Internal Revenue Service rate per mile, and the number of miles that staff project to travel to complete their assigned job responsibilities. Actual expenditures for FY 2013 and FY 2014 are lower than the amounts budgeted, and it may be possible to reduce the amount budgeted for FY 2016 more than the $25,211 that was already cut. Funds for travel to conferences and for professional development make up between 22 to 29 percent of the budgeted amount. Small amounts are budgeted in several units across the organization. The largest amounts are budgeted in the K-12 budget, and for required International Baccalaureate (IB) program training which may be held across the country one year, and then held locally another year.